Curriculum

The program curriculum is designed to move quickly from financial theory to practice real-world applications. From articulately presenting a stock pitch to learning to create a well-designed, functional and dynamic financial model, you will develop both strong technical and communication skills.

Core Courses

Whether we like it or not, as individuals and managers we evolve within various markets, and are subject to their rules. But how do world events shape our markets, decisions, and outcome predictions? This is the question we will address in our first theme, "Understanding Markets".

These markets are themselves part of the economy as a whole – Canadian and global. This economy goes through booms and busts over time – the business cycle – and these fluctuations have an important impact on prices, national output, unemployment, and indeed affect our daily lives. In our second theme, "Understanding the Economy", we will learn the tools necessary to understand business cycles and governments’ policy responses; and to form educated opinions about what we read on the subject in the news.

But beyond understanding markets and the economy, today’s managers face a myriad of economic issues when formulating strategies. Should we enter this market? Should we exit that one? What price should we charge? How much should we produce? Should we try and “deter” entry by a rival, or should we “accommodate”? In some markets – monopolistic markets – our ability to affect outcomes is strong. How can we use this market power to our advantage? Other markets are characterized by the fact that our actions affect, and are affected by, rivals’ actions and require a whole new set of tools – game theoretic tools. How can we use game theory to analyze these situations? These and other fundamental questions are addressed in our third theme, "Decision-Making in Market Environments".

The primary pedagogical objectives of the course are for students a) to familiarize themselves with important economic concepts, and b) to learn to use them as “tools” for efficient decision-making in business and other environments.

This course is an intensive program on financial modeling. During the course, participants will learn to create well-designed, functional and dynamic financial models. The course material includes model design, logic, construction, financial concepts, best practices and accounting treatment. Course topics include building financial statements, creating depreciation and tax schedules, forecasting and modelling working capital and capital structure, and creating discounted cash flow analysis.

This course will provide students with a brief review of the key principles of risk and return, modern portfolio theory, and market efficiency, which are critical inputs into both the corporate finance decision-making framework (through their impact on the cost of capital) and equity analysis (through their impact on the equity discount rate). Topics will include among others: risk and return; modern portfolio theory; capital market equilibrium models (including CAPM); fundamental economic, industry, and company analysis. Equity analysis will include a detailed and application-focused discussion of valuation models including the dividend discount model, free cash models and relative valuation approaches.

In addition to class assignments that will involve the analysis of real-world companies, students will also prepare a thorough analysis of an actual company to give them an opportunity to apply the concepts learned during the course to a real-life situation, and to assist in preparing them for the Toronto CFA Investment Research Challenge Competition.

MFIN 821 introduces students to the basics of corporate finance including: an overview of the financial system; a discussion of the importance of business ethics and corporate governance; a review of financial statement analysis; financial forecasting; bond and equity valuation; an introduction to risk management and portfolio theory; the Capital Asset Pricing Model (CAPM); how to determine a company’s overall cost of capital; and, a detailed discussion of capital budgeting decisions. The emphasis will be on applying the concepts to real-world situations using actual market and company data to examine company decisions and assess their future growth prospects and risks.

This course will provide students a comprehensive overview of the fixed income markets, the main debt instruments traded, types of issuers and investors, and practices in the industry. Our main focus is on the cash debt markets, with coverage of derivatives to enhance analytic tools in the subject, and on risk-management. Our goal is to bridge the gap between theory and practice by illustrating how models and theories inform best trading and risk management practices in the fixed-income space.

Course Goals:

- Linking bond theory with practice – use of market simulations and ‘mini’ cases in class to demonstrate and apply theory to real market instruments

- Building knowledge of current fixed income markets and issues

- Building bond portfolios – ability to incorporate yield curve, credit, capital structure and other variables into a comprehensive approach to fixed income portfolio management

- Understanding of bond mathematics, bond pricing and relative value of product across the credit spectrum

This course explores the theoretical and empirical evidence relevant for investing and portfolio management. We will focus on traditional assets (equity and fixed income) as well as alternative assets (e.g. commodities, real estate, private equity, venture capital) and investment style (carry, momentum, value). We will learn how to combine these assets and strategies into portfolios to achieve specific investment objectives. While the course is designed to meet the needs of students who might want to pursue a career in the investment field, the course will prove useful for personal investing as well.

This course provides a comprehensive overview of derivatives and the markets in which they are traded. We implement the manufacturing process underpinning linear as well as non-linear instruments and, in this process, uncover the key relationships employed by market participants to value them. Furthermore, we explore how derivatives are used by financial institutions, as well as by non-financial firms, to manage unwanted risk exposures and/or to enhance investment yields. The course covers plain-vanilla derivatives (e.g. futures, forwards, FRAs, swaps, and options) as well as more recent innovations, such as exotic options and credit derivatives. We also explore best practices in enterprise-wide market and credit risk management, as well as recent developments in the regulatory environment surrounding the derivatives marketplace.

This course is intended to enable students to connect and tie together the various program learnings from the MFIN program in a project course with an industry ‘client’. Students will work in teams, but also be responsible for various elements of the project as individuals, demonstrating critical thinking and problem-solving capabilities in resolving a real industry challenge. Elements of focus within the projects may include corporate development, law, technology, investments and computer science within a corporation, partnership, fund, or other for-profit business structure.

Learning will involve content delivery and hands-on experiential work as part of the project process.

Elective Courses (choose two)

Please note you must choose at least one of either Investment Banking or Sustainable Finance.

This course is designed to provide an overview of investment banking. Key areas it will cover include: capital raising, valuation methodologies, mergers & acquisitions and an overview of other corporate restructurings such as leverage buyouts. Both private and public markets will be discussed, including private equity, within the current global context. Given the previous courses the students have already taken in the MFIN program, in-class cases will be an important part of illustrating selected investment banking topics.

Distributed ledger technologies, like Blockchain and Ethereum, have changed how people view and transfer funds and how economics of the future will function. Central-bank issued digital currencies, Bitcoin and other crypto-currencies and tokens are changing the way that firms acquire funding. The course will cover the technology and economics driving these changes including consensus mechanism, use case and other application. These and other topics will be explored in depth during this course. This course will include joint sessions with Payments Canada that will include guest lecturers, a joint case study, and insight into the future of payments and payments regulation world-wide. Iso-labs will provide a payments sand-box for students to use.

This course provides a comprehensive overview of modern financial analytics. Topics will include traditional models such as: the CAPM, portfolio optimization, applied contingent-claims analysis, Altman’s-Z, Monte-Carlo methods and applied econometric models. In addition, the course will also cover recent advances in artificial neural networks and machine learning tools applied to forecasting financial time-series and corporate default as well as Block-Chain analytics.

The financial sector plays a critical role in our sustainable future since it is responsible for allocating funds to its most productive use. It is therefore well positioned to direct investments to sustainable corporations, organizations and projects, and assist in making strategic decisions on trade-offs among sustainable goals. By financing sustainable companies and endeavors, the finance sector can accelerate the transition.

Financial system participants, such as investors, have the power to exert their influence to drive sustainable business practices within companies that they invest in. Most importantly, finance can help certain sectors of the economy that are vulnerable to climate change shocks (i.e. transportation, insurance, reinsurance) in understanding and pricing risks associated with environmental issues. The Canadian Expert Panel report states that “Sustainable finance is both about building resilience to those widespread impacts and preventing further exacerbation.”

This intensive course will cover the major financial implications associated with climate change. Specifically, the course will examine the business opportunities and risks associated with climate change and sustainability. The structure and role of the major elements of the finance industry and finance policy, and the resulting shifts will be the major focus.

Course description coming soon.

Not all electives are available both remotely and in person, and they are subject to change given the demand for each topic in a given year.

Workshops

Compulsory

- Communication in Finance

Optional

- CFA exam preparation: A four-day intensive review of topics covered in CFA Level 2 and 3

- Merger Modeling

- Capital Structure (LBO) Modeling

Experiential Learning

Experiential learning, or “learning by doing” is one of the most effective ways to learn. Students in Smith’s Master of Finance program not only master the theoretical concepts, but learn how to apply these concepts to real-life opportunities.

Case Competitions

- CFA Research Challenge

- CFA Ethics Challenge

- Van Berkom Small Cap Case Competition

- National Investment Banking Competition

Clubs

- Queen’s University Alternative Assets Fund

- Class Executive

- Smith Women in Finance

- MFin Gives Back

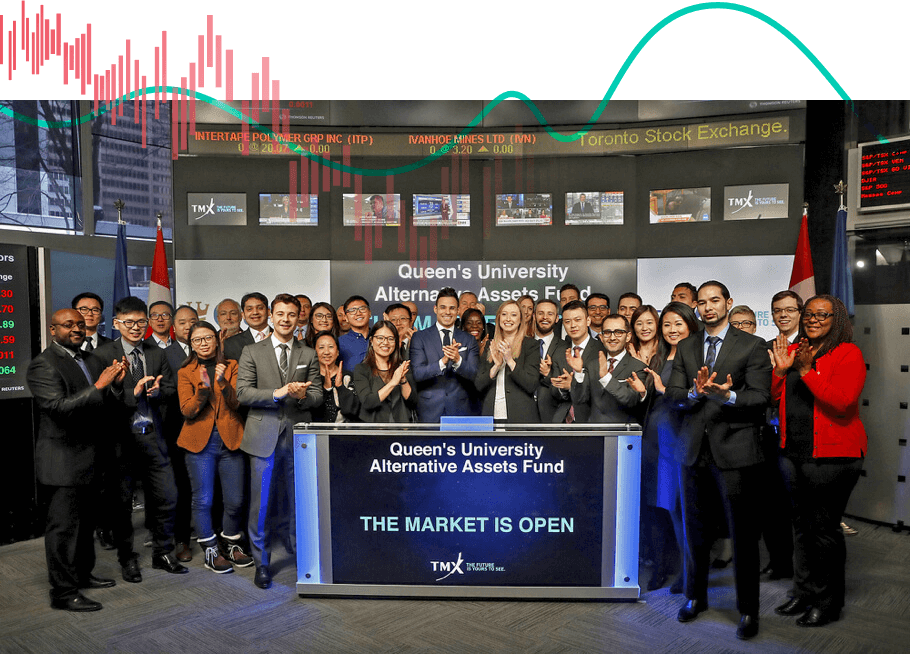

Queen's University Alternative Assets Fund

QUAAF is the only student run hedge fund in North America and was the brainchild of four Master's students at Smith School of Business. The student management group consists of a mix of MBA and Master of Finance students that comprise an Executive Committee and teams of Analysts. They are supported by an Advisory Committee of industry professionals. This fund has been seeded with contributions from alumni and friends of Queen's, and all proceeds contribute to the maintenance and expansion of the fund.

Learn more about QUAAFCFA Institute Research Challenge

As a Master of Finance student, you will have the opportunity to participate in the CFA Institute Research Challenge. This is a competition between university-sponsored teams that involves researching a designated publicly traded company, preparing a written report on that company and presenting your findings to a panel of judges. Competition takes place at the national, regional and global level.

“QUAAF allows students to take leadership roles in a capital markets’ environment. As a team, we’d meet weekly, do a market update, and then review our portfolios. As leaders of QUAAF, we were required to take a firm view of the financial markets and speak about them fluently. We were investing real money, so we had to do real research. When I came in as CEO, I wanted to ensure there was a process around everything. I used what we were doing as part of the CFA Research Challenge and brought it to QUAAF.”

Fixed Income Credit Analyst

AGF Investments Inc.

Partnerships

Smith's Master of Finance is a proud partner of the CFA Institute (Chartered Financial Analyst) and the CAIA (Chartered Alternative Investment Analyst Association).

CFA Partner

The Chartered Financial Analyst charter is the gold standard for investment practice, demonstrating expertise, experience, current practice, timeless investment principles, and a commitment to exemplary ethical standards. CFA Program Partner status is awarded to high profile universities of global stature that embed a significant percentage of the CFA Program Candidate Body of KnowledgeTM (CBOKTM) into their degree programs.

CAIA Academic Partner

The CAIA Charter is the educational benchmark for the alternative investment industry, which includes hedge funds, commodities and managed futures, private equity, credit derivatives and real estate. The CAIA Association® academic partnerships are awarded to accredited academic institutions whose curriculum covers a significant portion of the subject matter addressed in the CAIA program.